I. The German cannabis market in Summer 2022

- In just a few years, Germany has developed into an important sales market for medical cannabis.

- In 2021 alone, statutory health insurance (SHI)-accredited physicians working in the statutory health insurance system prescribed cannabis-based medicines to the tune of some EUR 185 million, marking a growth of slightly more than 12% over the previous year. In 2018, sales stood at EUR 74 million.

- In 2021, the number of prescriptions for medical cannabis rose to 372,000, compared to 340,000 in 2020. Unprocessed cannabis flowers accounted for almost EUR 70 million and cannabinoid-containing medicines for a further EUR 46 million.

- No reliable figures are available for self-payers and private patients. Sales may actually be higher than the statistics for the SHI system indicate because medical cannabis is only prescribed for SHI patients subject to very strict requirements – many of them obtain it on private prescription and pay for it themselves.

- But there are further major changes on the horizon – the cannabis market is set to be liberalised to allow the use of cannabis for recreational purposes. In June 2022, the Federal Government’s Drug and Addiction Commissioner held a large number of consultations on the subject of the coalition government’s decision to allow the sale of cannabis for recreational purposes. The Federal Government is expected to publish a draft bill at the end of the year.

- There is no saying at this stage, however, whether liberalisation will actually end up boosting sales of medical cannabis as well, especially since June 2022 also saw major changes in the price framework for medical cannabis dispensed within the German health system.

- There follows an overview of the current legal framework for medical cannabis by Enno Burk, Dilara Puls and Xiao Chen, who will also provide a summary of the picture as regards the upcoming liberalisation of cannabis for recreational purposes. They are members of Gleiss Lutz’s Berlin-based Healthcare practice group and one of their focuses is pharmaceutical and narcotics law and the statutory health insurance system.

II. Legal classification of medical cannabis

1. Medical cannabis as a medicinal product

From importation and production right through to prescription within the statutory health insurance system and charging of the costs for prescribed medicines, the German market for medical cannabis is strictly regulated.

- Even when used for medical purposes, therefore, cannabis is regarded as a non-marketable narcotic that is subject to the German Narcotics Act (Betäubungsmittelgesetz, “BtMG”). For that reason,

- import into Germany,

- wholesale distribution in Germany,

- processing steps within the meaning of the Medicinal Products Act (Arzneimittelgesetz, “AMG”),

- storage, and

- advertising, are governed by rules and licensing requirements spread across various different laws.

- In addition to that, medical cannabis must be prescribed by a doctor, and the doctor must draw up a detailed case history of the patient in an in-person consultation.

- Cannabis may not be prescribed for the first time on the basis of a tele-consultation.

- Only for certain serious illnesses may doctors prescribe cannabis for reimbursement by the statutory health insurance system. Otherwise, they could find themselves facing recourse claims.

- Under narcotics law, prescribing medical cannabis has to be a “means of last resort”.

- Prescribing cannabis for recreational purposes without a compelling medical indication (usually chronic pain relief) is not permitted.

- Approval by the health insurance fund is also required.

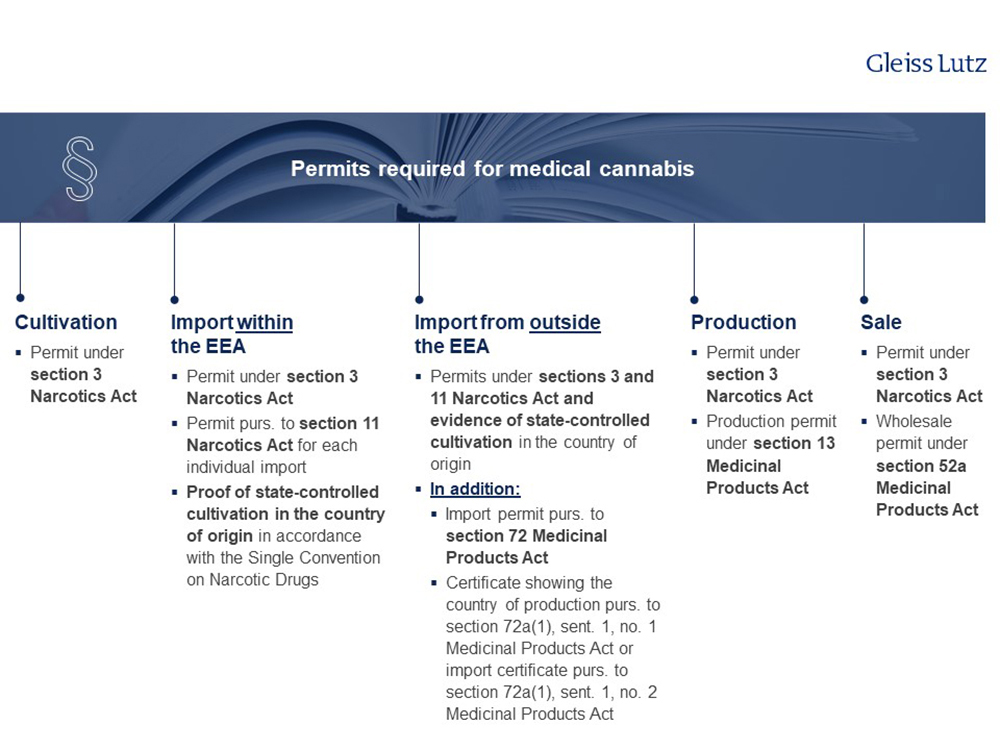

2. Growing, importing, producing and selling medical cannabis – what permits/licences are required?

The permits/licences required depend on the type of business activity and are shown in the following chart.

Please find the overview in high resolution here.

3. Pharmacy-only for medical cannabis – sale as a magistral preparation or a proprietary medicinal product

- Medical cannabis may only be provided to patients by a pharmacy – including by mail order if they have a mail-order licence – and on presentation of the relevant prescription.

- Section 21(1) AMG stipulates a marketing authorisation for proprietary medicinal products, but this does not apply to medical cannabis sold in the form of dried flowers. This is because the flowers are not produced, packaged and sold in advance as a proprietary medicinal product, but are the starting material to be used by pharmacies to produce a patient-specific magistral preparation.

- Where a proprietary medicinal product prepared in advance contains active substances from the cannabis plant, on the other hand, this is subject to the usual marketing authorisation requirement under medicinal products law.

- In the German pharmacy market, there are meanwhile a few dozen mail-order pharmacies that focus on supplying prescribed medical cannabis and have the necessary supply relationships with specialised wholesalers and importers.

III. Reimbursement of costs, and new pricing rules introduced in SHI system in June 2022

1. Statutory health insurance

- Under section 31(6) German Social Security Code, Book V (Sozialgesetzbuch, “SGB V”), patients with a serious illness are entitled under certain circumstances to receive medical cannabis in the form of dried flowers or extracts. In addition, where a patient is prescribed cannabis for the first time, this requires approval by the health insurance fund, which may only be refused in justified exceptional cases.

- Until now, based on the price agreements with pharmacies applicable to the health insurance funds, the chargeable rate for cannabis flowers of all varieties in their unprocessed state as well as in preparations was EUR 9.52/gram, regardless of the variety.

- However, according to an arbitral award issued in June 2022, different charging rules are to apply retroactively as from 1 June 2021:

- The chargeable rate is the ex-factory price of EUR 4.30/gram announced by the Federal Institute for Drugs and Medical Devices (Bundesinstitut für Arzneimitel und Medizinprodukte, “BfArM”), plus pharmacy markups.

- Since BfArM cannabis flowers are only placed on the market in 50-gram packages and the shelf life is often less than six months, the arbitration board has laid down a rule for the charging of destroyed BfArM cannabis flowers:

- Between five and a maximum of 45 grams of destroyed BfArM cannabis flowers from a package may be charged at EUR 4.30/gram.

- Pharmacies must cancel any charging done for magistral preparations since 1 June 2021 on the basis of the previous rules and charge them again.

2. Private health insurance and self-payers

- For patients with private health insurance, there is no requirement for authorisation for the prescribing of medical cannabis.

- Nevertheless, depending on the reimbursement rates agreed in their contract, their health insurance funds may refuse to assume the costs – e.g. if the therapy is not deemed medically necessary in the particular case. Patients insured under the statutory health system can also have medical cannabis prescribed on a self-paying basis if, for example, they want to use it for palliative purposes before the health insurance company has given its approval, as the approval procedure often takes several weeks.

- For pricing purposes, the provisions of the Medicinal Products Price Ordinance (Arzneimittelpreisverordnung) for magistral preparations apply.

- The price per gram of cannabis flowers in magistral preparations is always based on the lowest purchase price paid by the pharmacy. The purchase prices are freely negotiable between wholesalers and pharmacies.

IV. Which authorities are responsible?

1. Cannabis Agency

- The Cannabis Agency, a department of the BfArM, is responsible for

- the supervised cultivation and harvesting,

- processing and quality inspection,

- storage, packaging and sale of medical cannabis flowers produced in Germany.

- The Cannabis Agency sells the cannabis flowers produced in Germany to pharmacies in its own name as a pharmaceutical entrepreneur and wholesaler and therefore also sets the ex-factory price for cannabis flowers that the pharmacies have to pay.

- However, the Cannabis Agency is not responsible for the import of cannabis flowers. Cannabis products are imported and sold through private pharmaceutical wholesalers and importers.

2. Federal Opium Agency

The Federal Opium Agency is also a department of the BfArM and it monitors the trade in narcotics and precursors in Germany.

- It issues licences for the import and export of narcotics (incl. psychotropics) and precursors from the EU.

- It also monitors the movement of narcotics and precursors among licence holders (manufacturers, traders, importers, exporters, growers and scientific institutions) and carries out inspections of premises and storage facilities.

3. State authorities responsible in the case of imports from third countries

- When medical cannabis is imported from non-EU countries, the import permit required by the customs office is granted by the responsible state authority of the federal state into which the cannabis is being imported (cf. section 72a(1), sentence 1, no. 2 AMG).

- The state authority also assesses whether the production in the third country is in compliance with GMP standards and checks whether a body equivalent to the German Cannabis Agency is monitoring the cultivation of cannabis for medical purposes.

4. Germany as an import market for medical cannabis

- Following a tender procedure in 2019, the Cannabis Agency awarded a contract for the cultivation, harvesting and distribution of cannabis for medical purposes in Germany. The contract was awarded to three companies and covered a total of 10.4 tonnes to be produced and sold over four years.

- This amount does not even come close to covering the annual demand in Germany. In 2021, around 20.6 tonnes of cannabis in the form of dried flowers and extracts was imported from EU states such as the Netherlands or third countries like Canada. Thus, the amount imported is almost ten times that of the cannabis quantities produced each year in Germany (approx. 2.6 tonnes p.a.).

- However, the BfArM cannabis is cheaper than imported cannabis: the price per gram is EUR 4.30 (for 50-gram packages).

V. Legalisation of cannabis for recreational purposes expected in 2023

On 25 October 2022, the German government adopted a key proposals paper outlining the material provisions of the intended law on the liberalisation of the consumption of cannabis for recreational purposes. This paper is now to be submitted to the EU Commission for review and, if no concerns are raised, a draft bill will be presented. According to the latest information from the Federal Ministry of Health, the bill should be ready by the end of the first quarter of 2023 and could therefore be presented to the Bundestag in the second half of the year. In order to prove to the EU Commission that the proposals comply with European and international law, an expert report is to be prepared in parallel to the drafting process, which is to answer two crucial questions in particular. One, will it be possible to curb the black market without expanding consumption through legalisation? And two, how well will children and adolescents be protected? It is still uncertain whether the Commission will give the go-ahead.

For more information on the German government’s key proposals please see our client update “German government adopts key proposals paper on cannabis legalisation”.