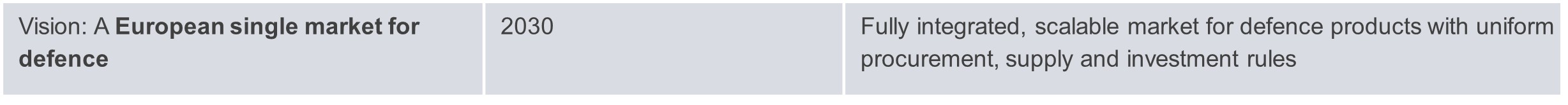

The Defence Readiness Roadmap 2030, jointly presented by the European Commission and the High Representative for Foreign Affairs and Security Policy on 16 October 2025, clarifies the agenda launched in spring to enhance European defence capabilities. It builds on the Defence Readiness Omnibus, which is intended to establish a regulatory basis for simplified procedures, transfers, and procurements and is still under negotiation. While the omnibus (Defence Readiness Omnibus – the next step towards European defense capability | Gleiss Lutz) primarily comprises regulatory reform, the roadmap sets out the industrial, financial and competition-related steps to be taken up to 2030 – with the aim of achieving an integrated European defence market through joint procurement, industrial integration and predictable investment cycles. The Commission and the High Representative set clear priorities, timelines and enablers for Europe’s defence industrial ramp-up. The roadmap brings planning certainty and sets guardrails for M&A and investment strategies in Defence & Space over the months and years ahead.

From legal framework to industrial implementation

The Roadmap 2030 marks the transition from regulation to industrial scaling. It cites four flagship initiatives – European Drone Defence Initiative, Eastern Flank Watch, European Air Shield and European Space Shield – as well as nine priority capability areas in which critical gaps are to be closed by 2030 through joint development and procurement:

- Air & missile defence

- Strategic enablers

- Military mobility

- Artillery systems

- Cyber, AI & electronic warfare

- Missiles & ammunition

- Drones & counter-drones

- Ground combat

- Maritime

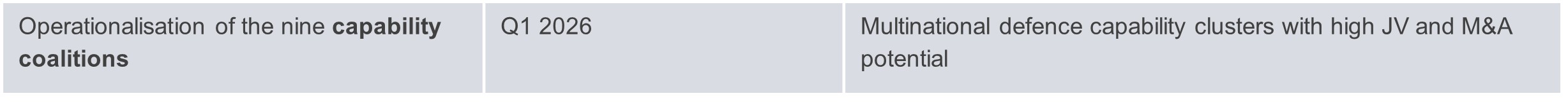

The corresponding so-called capability coalitions are to be operational by the beginning of 2026.

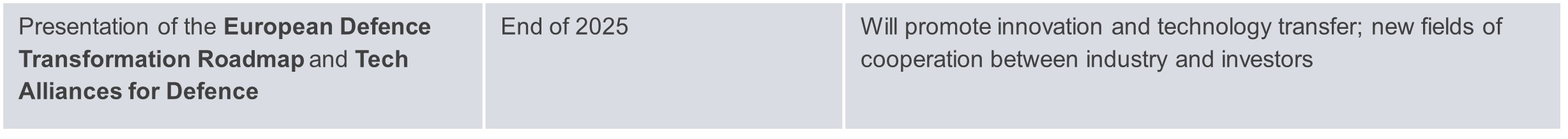

The Commission and the High Representative have also announced a European Defence Transformation Roadmap and Tech Alliances for Defence for the end of 2025 / beginning of 2026. These initiatives will address technology gaps and foster knowledge transfer between industry, research and investors – strengthening cross-sector collaboration and deal-driven alliances.

The roadmap emphasises that four years of war in Ukraine have shown how critical it is to have sufficient stocks of ammunition and equipment, and to have scalable production lines and well-synchronised supply chains. Public and private investment must therefore support the scale-up of industrial ecosystems in the next five years, generating noticeable benefits for regional value creation and employment.

Relevance for M&A

The regulatory framework for simplified procedures, intra-EU transfers and joint procurement is expected to be clarified by the end of 2025 upon conclusion of negotiations on the Defence Readiness Omnibus.

New strategic and regulatory framework conditions are likely to apply to M&A activities in the European defence industry:

- There is political support for consolidation, particularly where it enhances capacities, interoperability, and supply chain resilience.

- Capability coalitions will facilitate cross-border integration, with investment activities – including joint ventures and minority shareholdings – focusing on priority military capability areas.

- Merger control and FDI screening remain key review mechanisms, as mergers in security-relevant sectors generally require official authorisation.

- The Commission is also examining whether to modernise its approach to State aid for the defence sector and, if necessary, to issue specific guidelines, which would represent an important step for transaction-based funding models (see below).

In addition, the revision of Directive 2009/81/EC on procurement in the fields of defence and security remains a key reform project: simplified procedures for joint procurement are intended to facilitate market access.

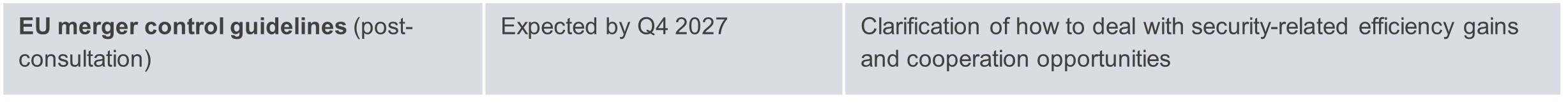

At the same time, the Commission is planning supplementary EU merger control guidelines to clarify how safety-related efficiency gains will be assessed in future.

This will create an environment that is conducive to industrial consolidation without undermining competition. Successful M&A strategies will need to consider industrial scaling and competition together.

Relevance for private equity

The roadmap will also make the defence sector more investable, significantly enhancing the environment for private equity funds:

- Defragmentation and standardisation will increase scalability, making platform strategies for specific capability fields a realistic prospect.

- Demand cycles and coherent funding (SAFE, EDIP, EDF, the future European Competitiveness Fund) will create predictable investment horizons.

- Cooperation projects and participation models, including public-private structures, are identified as desirable policy instruments for fostering industrial scale-up.

- Changes in State aid rules may also facilitate industrial consolidations, provided these serve to develop capabilities.

Starting in 2027, the future European Competitiveness Fund – through its window for resilience and security, defence and space – will become the first dedicated EU financing instrument to open industrial scale-up projects to PE-structured capital. In combination with SAFE, EDIP and EDF, this will create a clear funding path for long-term defence investments.

At the same time, FDI procedures, export controls and ESG restrictions remain relevant. Hurdles to investment will reduce but regulatory complexity will remain high.

Competition as guiding principle in industrial integration

The Commission and the High Representative stress that the industrial ramp-up should be guided by competition law, emphasising its readiness to provide competition guidance on cooperation projects in the defence sector and its work with Member States to assess whether it should modernise its approach under State aid rules in the sector and possibly provide guidelines.

The signal from Brussels is that the objective is not to hinder cooperation but to help ensure it meets existing competition laws.

The Commission’s goal of increasing industrial cooperation without weakening competition therefore remains unchanged.

Timeline and regulatory framework

The following milestones illustrate how the industrial and regulatory framework will develop by 2030. In addition to the full implementation of the roadmap, new mechanisms such as the EU-wide military mobility area and the annual defence industrial summit will be decisive for investment decisions and site selection.

The planned measures show that while the roadmap towards establishing industrial defence capability is ambitious, it is still largely dependent on legislative progress and practical implementation by the Member States.

Assessment – achievements and limits

The roadmap shows clear progress on the integration of the European defence market. However, key questions about the regulatory and financial environment remain unanswered. Our preliminary assessment:

Achievements:

- Politically driven industrial scaling with clear timelines: The roadmap sets out the first binding schedule for capability development, joint procurement and market consolidation.

- Improved market access and scalability through defragmentation and standardisation: The creation of capability coalitions, combined with more uniform procurement practices and cross-border cooperation, creates strategic predictability for industry and capital.

- Competition and State aid law seen as enablers: With the announced competition guidance and planned modernisation of the State aid framework, the Commission is shifting its focus from a control-oriented to a development-oriented approach to defence cooperation projects.

- Merger control remains a touchstone, but with more focus on efficiency and resilience gains through consolidation (e.g. faster series production, interoperability, robust supply chains).

Limits:

- Omnibus package still in the legislative process: Key simplifications to procurement and transfer procedures are still subject to agreement in the Council and Parliament.

- No harmonisation of national authorisation and control regimes: FDI, export and security screenings continue to follow different paths, delaying cross-border transactions.

- Continuing restrictions on ESG financing: Defence investments are still excluded from large parts of the sustainable finance taxonomy, limiting access to capital and fund structuring options.

- Cooperations between competitors must remain limited to clearly defined development or production phases, with clear antitrust compliance requirements as well as ringfencing and other information barriers being essential; uniform EU guidelines have yet to be issued.

- Abuse control is also of increasing importance, particularly in cases involving a dominant market position in key technologies such as sensors, cyber, and AI and cloud applications.

Recommended actions

Now is the time for companies and investors to align their strategies and structures with the roadmap milestones, with a clear focus on transaction readiness and regulatory compliance:

- Align M&A strategies with capability objectives and funding structures early on.

- Bring project and investment planning in line with EU milestones (investment, exit and financing decisions).

- Ensure integrated planning of FDI, merger control and State aid screening.

- Ensure cooperations are structured to comply with antitrust law (clean teams, limited exchange of information, tied to specific purpose).

- Adapt private equity structures for co-financing with EU programmes (SAFE, EDIP, EDF and, in future, the Defence Competitiveness Fund).

- Ensure that ESG strategies deliver the required resilience and security (investments in European defence readiness).

Companies and investors considering strategic transactions in the defence sector should take advantage of the current political momentum favouring the consolidation and defragmentation of the European defence industry and creating opportunities for strategic acquisitions, investments and mergers.

Those who act now will secure early access to Europe’s emerging industry and procurement networks – and benefit from increasing regulatory planning certainty, industrial scalability and new financing options.

Conclusion

The Defence Readiness Roadmap 2030 sets a new course for defence industry policy while working within the EU’s existing competition law framework. It opens up the defence sector to capital and cooperation – without abandoning the legal guidelines.

The key takeaway for M&A dealmakers and private equity investors: Defence will become more investable but will remain highly regulated.

Those who succeed in combining regulatory foresight with technological innovation and industrial scaling in the months and years ahead will be able to shape Europe’s development of its defence-industrial capabilities in the long term.